HUMAN-CENTERED DESIGN

Creating an MVP tool for a money management platform for low income single mothers

HOW IT STARTED

It all started December 2020 when I was accepted into a four month virtual product fellowship with Blue Ridge Labs - a social impact technology incubator through the Robin Hood Foundation, New York’s largest poverty-fighting organization. Every year fellows are brought together to try to understand the needs and the lived experiences of low income New Yorkers so they can prototype new software solutions that would address those challenges.

THE TEAM

I paired with a coding super hero - Michael Dinnal and in just 2 months, we performed over 20 one-on-one interviews, 4 focus groups, multiple online surveys, extensive user testing (moderated and un moderated) with a ton of prototyping and iterations so that we could ideate and create our MVP for low income single mothers who were looking to get out of debt.

Our Solution

EMERGE is a money management platform that was built to help single mothers take control of their financial security by demystifying all things money and finances. Emerge provides a debt payoff tool that helps individuals to develop a debt payoff strategy by giving them insights into how debt is calculated and allowing them to play around with the numbers. Our goal is to help them gain insights so they can make the best financial decisions for their families and achieve their goals.

RESULTS

70% of pilot users said the tool helped them understand their credit card statements and how payment works

Financial advisors report that when using the tool with their clients, it is easier to explain and to create plans

STEP BY STEP PROCESS - AlL REMOTE

Inspiration Phase

Discovery

We began by conducting focus groups and interviews with people from the community. The prompts were open and the goal was to hear about people experiences over the past year (when the Covid-19 lockdowns began) and how it affected them. As we listened one of the many topics that kept coming up, one pattern that caught our attention was around the topic of generational wealth and financial literacy when it came to single mother families. They were deeply concerned about their credit and how it affected their ability to achieve their long term goals.

Validation

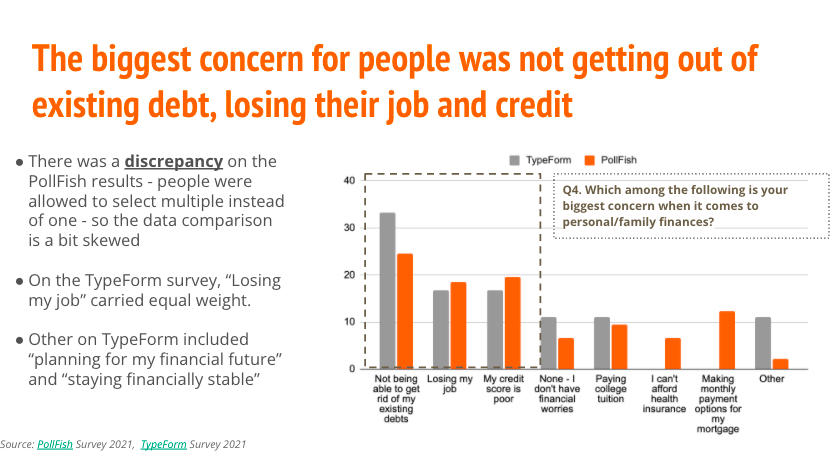

To validate what we had heard, we ran multiple surveys (English and Spanish) to understand how single mothers felt about their finances and to learn how we could help them. We heard back from 189 mothers using different channels: TypeForm Survey on social (Twitter, Facebook, Reddit), Paid Survey Service (PollFish), Fresh EBT (now Providers) - an EBT app. The top 3 areas people wanted help with matched what we heard in discovery - Getting out of existing debt, How to build/improve credit and How to save more

Immersion

Conducted a series of zoom calls to talk to some of the mothers about their finances - their concerns around debt and credit. We wanted to know how they currently managed their finances, what their goals were, which apps the were using and what they felt was lacking in general. From our calls, we saw that the current solutions in the market did not serve the needs of low income families and that trust was going to be a big factor when it came to building a solution that would work for them. Using empathy maps we solidified our target user

Ideation Phase

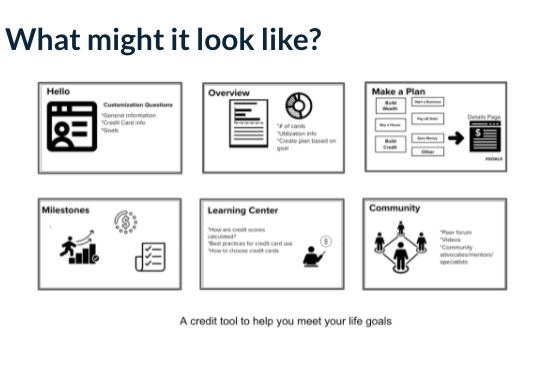

After identifying our design challenge and speaking with many experts, our multiple brainstorming sessions led us to focus on helping mothers create actionable plans to pay off credit card debt

Our initial idea was around building credit but because building trust was a huge part of process, we wanted our potential solution to not require personal or important information such as a social security number or connections to banks accounts for it to provide value. Also, from our above research and conversations, we realized that the local financial organizations played a huge role when it came to our target users so we wanted to create something that could be used during the sessions.

Implementation Phase

Rapid prototyping, user testing and iterating

In the initial stages, I used FIGMA to create rough concept screens of our idea. These we used to get feedback from single mothers to make sure we were on track and that our proposed solution was something that our users would find useful. As we progressed, we created a rough clickable prototype of the calculator so we could start getting feedback on the elements within the tool. As part of our tests, we iterated on text copy to make it easier to understand, the placement of items, the color palette and had multiple iterations on visual aids to help simplify the concept of principal/interest.

Validation Phase

Our tool went live with the calculator open for use. We wanted to see if our idea of what out target users wanted matched what they needed so we invited our mothers back to perform unmoderated usability tests on the the live tool. We also collected feedback on what could be improved and what worked well for them. We also launched 2 pilots with a professional financial counsellor to use with clients to help them create a debt payment plan.

Visit EMERGE to see the current version of our tool.